Viewing 2025 Trend Predictions Through a Very Wide Lens

Capturing the consumer zeitgeist has never been more challenging for food companies. Food preferences change as fast as the news cycle, and today’s TikTok food craze will be old news by tomorrow.

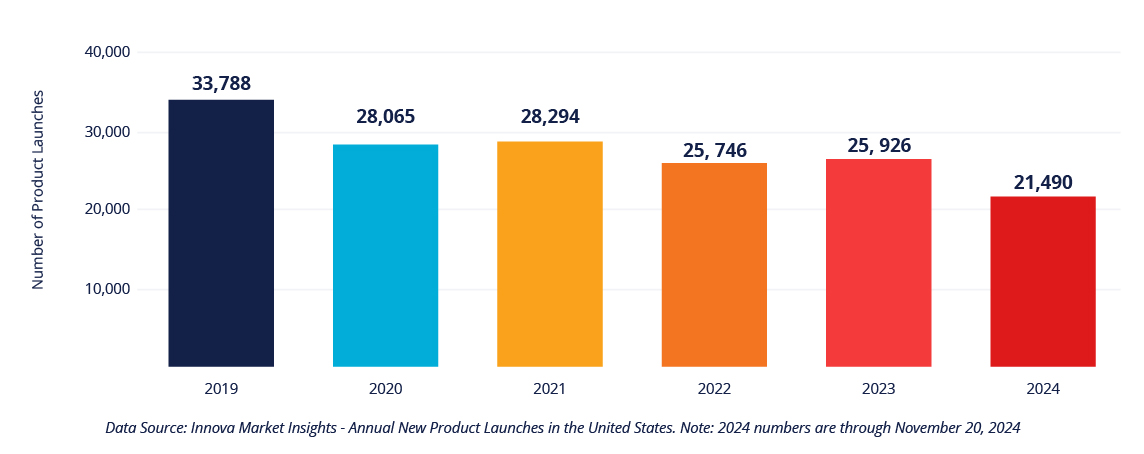

The number of new products launched annually reflects this difficult environment for innovation. Since COVID, the packaged food industry has been mired in an innovation gap, and 2024 is looking especially bleak unless there is a massive wave of innovation in December.

From this lens, we looked at our annual trend prediction assessment from a very wide lens, shunning specificity (hello ube and black garlic), in favor of finding consumer patterns that will help food brands smartly launch successful new products that will endure.

Bluegrass Ingredients has always been on the cutting edge of rapid new product development to capture the latest flavor or seasoning trend, and we’ll continue to focus on this area for companies wanting to quickly hit the market in an efficient and cost-effective manner. However, we’re also adding to our strengths by taking a longer look at consumer patterns and how they will influence new product development.

From that perspective, here are our “Top 3 Trends to Watch” from the countless predictions we read.

Trend One

Tradition Revived from Innova Market Insights

Although brand collaborations/fusions are at an all-time high, consumers appear to be stepping back from the food fusion craze of mashing up two traditional cuisines into something new, especially in the CPG industry. As the world becomes more global, consumers want to experience culture authentically, not mashed up with something else. Innova predicts that this will have an impact on new product development as consumers seek out products that express their heritage and show a diversity of food cultures.

We see this trend playing out in two ways. Authentic global cuisine finding a home in middle America, and the continued rise of nostalgia across all food categories. We’re especially paying close attention to the flavors of comfort food (mac and cheese, peanut butter and jelly), and how they can find new homes in everything from ice cream to candy.

Trend Two

Yes Chef from the Specialty Food Association

Inflation has eased, but for many consumers, it’s still too expensive to go to a restaurant. Specialty Food Association predicts, and we agree, that there’s an opportunity for restaurant-quality food to thrive throughout the grocery store. The challenge with this trend is formulating “affordable indulgent” foods and beverages.

We tackle this challenge continually by replacing dairy ingredients in dips, sauces and prepared foods with dairy powders and concentrates that are clean label and save costs on everything from shipping to storage. Other tactics to capitalize on affordable indulgence:

- Look to global flavors for inspiration, especially Asian cuisines

- Single-serve desserts are perfect for a small, affordable luxury

- Texture will be big in 2025, with opportunities to create even creamier and crunchier foods and beverages

Nestlé had a similar trend prediction for 2025, calling it Flavor Done Fast. According to the food giant’s data, “68% of consumers are trading restaurant meals for supermarket food. They highlight two areas that we’ve done significant innovation work in: sauces and marinades. We anticipate the market for these products to boom for the next three years as consumers look for quick fixes to elevate their meals.

Trend Three

Food Dupes from Kroger

Kroger obviously has a self-interest in predicting that private label will continue to “rival — and even surpass” national brands. The data does not lie though, and it’s clear that private label is booming not only in terms of sales but also in its focus on innovation. This is a good thing for the entire food industry, and a paradigm shift that we believe will help the food industry exit the innovation gap.

With a strong private label sector challenging national brands on quality and cost, we anticipate a wave of innovation in the next five years. Bluegrass Ingredients will be ready to meet the innovation needs of all in the food industry by understanding the flavors of the month as well as the shifts in consumer behaviors that will impact the next five years of food consumption.

As the year draws to a close, contact Bluegrass Ingredients to form a partnership that will prepare you to thrive in today’s food industry, whether your focus is on cost cutting or true innovation.